Author: Deepika Charugundla

Dynamics Technical Consultant

Long View

Basic concept of Cost Accounting:

Cost accounting provides the essential cost details necessary for overseeing your operations and making well-informed decisions. Typically, the responsibility for producing this information rests with the accounting and finance teams. Microsoft Dynamics 365 Business Central can assist you in allocating actual or budgeted costs from your operations to your cost centers and cost elements (such as materials, labor, and overhead) for profitability analysis.

Dynamics 365 Business Central enables you to define:

- Cost types

- Cost centers

- Cost objects

This facilitates the analysis of what the costs entail, their origins, and who should bear them. You create a chart of cost types structured akin to your general ledger chart of accounts. You can either transfer the general ledger income statement accounts or establish your own chart of cost types. The system will guide you through the process of setting up your chart of cost types, encompassing the assignment of cost centers and the allocation of costs.

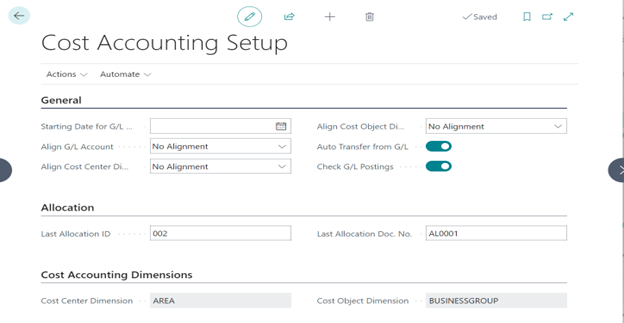

Cost Accounting setup:

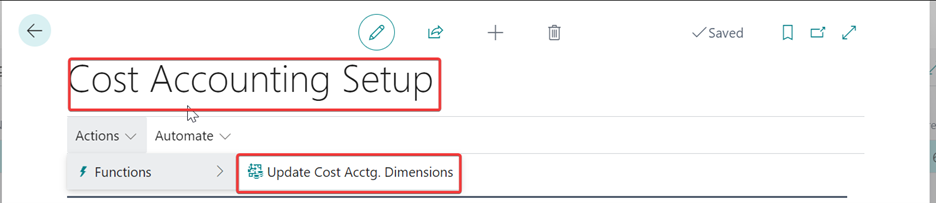

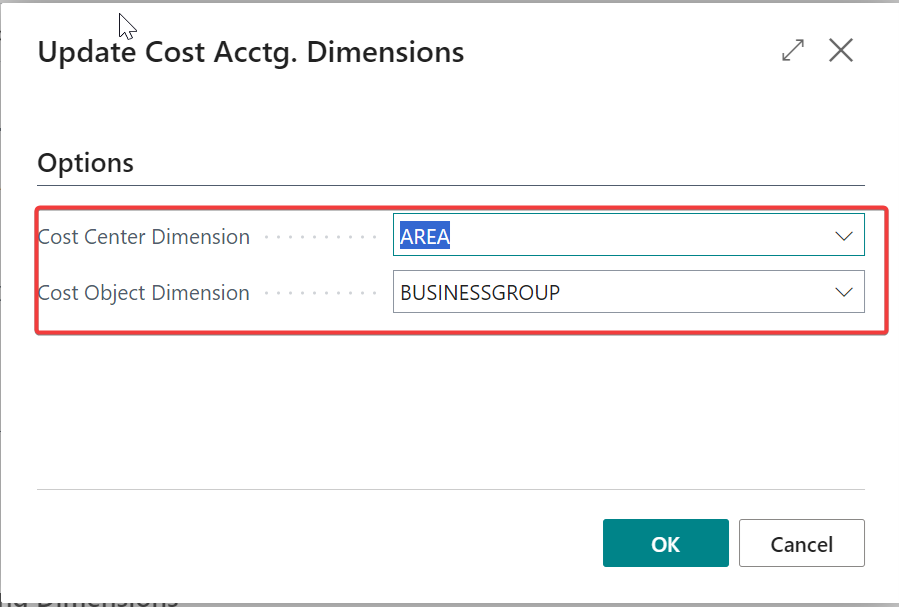

Following Setup need to be to update in Cost Accounting.

- Auto Transfer from G/L: Business Central updates the cost accounting after every posting in the general ledger. Combined entries are not possible.

- Update Cost Acctg. Dimensions: Update existing cost center and cost object dimensions to the new cost center and cost object dimensions.

Cost Type:

The chart of cost types is similar to the chart of accounts in the general ledger. You can set up the chart of cost types in the following ways:

- Structure the chart of cost types similar to the income statement accounts in the general ledger chart of accounts. Then, you can transfer the general ledger chart of accounts to the chart of cost types. You can make any necessary adjustments after the transfer.

- Create new chart of cost types or add new cost types to existing chart of cost types. You must create each new cost type individually.

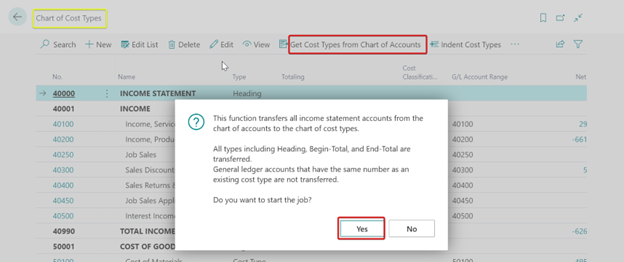

Transfer the general ledger chart of accounts to the chart of cost types:

- Go to Chart of Cost type and click on Get Cost Types from Chart of Accounts action.

- Click on yes, the action uses the chart of account to create the Chart of Cost type.

- Now Chart of cost type contains all the income statement accounts in general ledger.

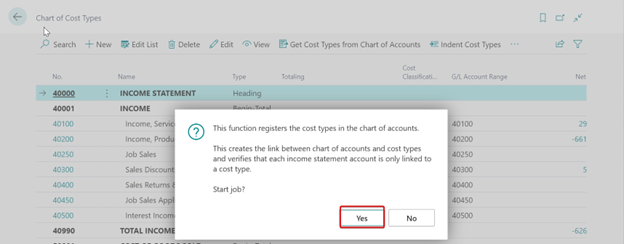

- Click on Register Cost Types in Chart of Accounts action to updates the relationship between the chart of accounts and the chart of cost types.

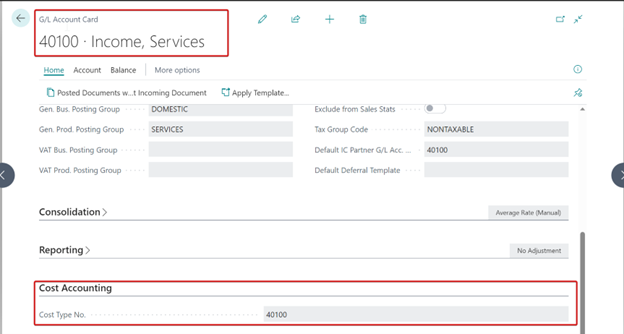

The relationship between the cost type and the general ledger account is created in the both the accounts.

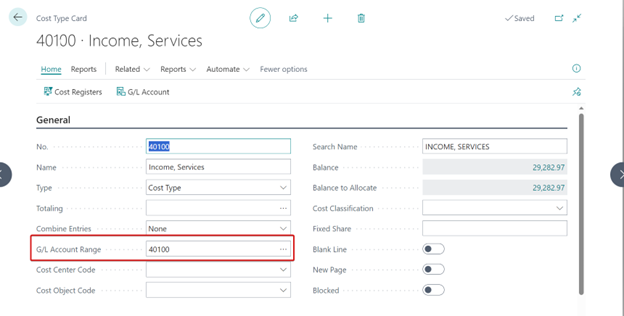

- The G/L Account Rangefield in the Cost Type table establishes which general ledger accounts belong to a cost type.

- The Cost Type No.field in the chart of accounts establishes which cost type a general ledger account belongs to.

These two fields are filled automatically when you use the Get Cost Types from Chart of Accounts function.

Cost Center:

Cost centers are departments that are responsible for costs and income. The chart of cost centers is similar to the dimension information for the general ledger. You can set up the chart of cost centers in the following ways:

- Transfer dimension values in the general ledger to the chart of cost centers. You can make any necessary adjustments after the transfer.

- Create a new chart of cost center that is independent of the general ledger or add a new cost center to an existing chart of cost center. You must create each cost center individually.

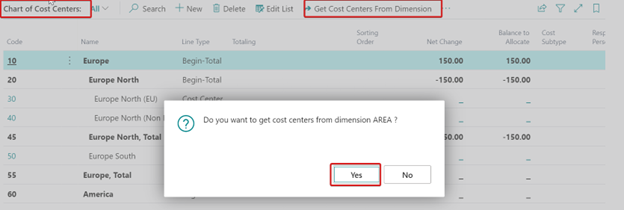

To transfer dimension values in the general ledger to the chart of cost centers

- Go to Chart of Cost Centers, and then choose the related link.

- On the Actions tab, in the Functions group, choose Get Cost Centers from Dimension to transfer dimension values to the chart of cost centers. The function transfers the dimension values that are defined in Cost Accounting setup.

Cost Center:

Cost objects are projects, products, or services of a company. The chart of cost objects is similar to the dimension information for the general ledger. You can set up the chart of cost objects in the following ways:

- Transfer dimension values in the general ledger to the chart of cost objects. You can make any necessary adjustments after the transfer.

- Create a new chart of cost object that is independent of the general ledger or add a new cost object to an existing chart of cost objects. You must create each cost object individually.

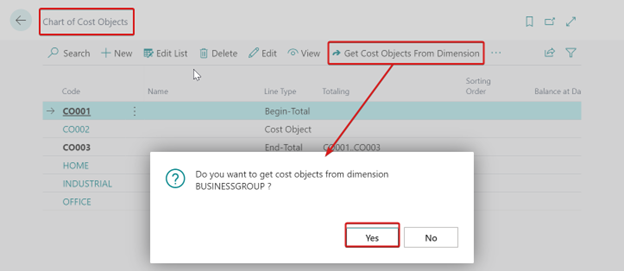

To transfer dimension values in the general ledger to the chart of cost objects

- Go to Chart of Cost objects, and then choose the related link.

- On the Actions tab, in the Functions group, choose Get Cost objects from Dimension to transfer dimension values to the chart of cost centers. The function transfers the dimension values that are defined in Cost Accounting setup.

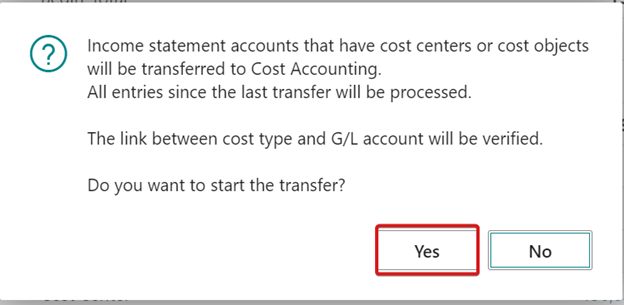

Transfer general ledger entries to cost entries:

- Go to Transfer GL Entries to CA, and then choose the related link.

- Choose the Yes button to start the transfer. The process transfers all general ledger entries that have not already been transferred.

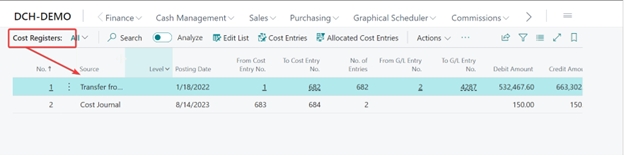

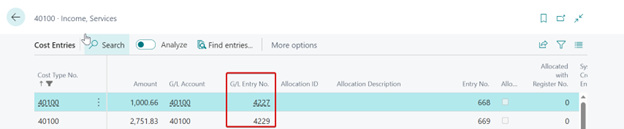

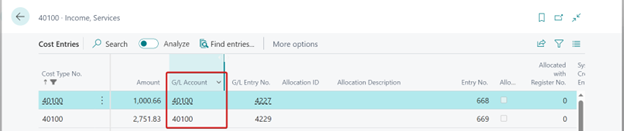

Results of Transferring General Ledger Entries to Cost Entries:

- During the transfer, the process creates connections in the entries in the Cost Entry table and the Cost Register table. This makes it possible to trace the source of cost entries.

- During the transfer of general ledger entries to cost entries, Business Central creates connections in the entries in the G/L Entry table, the Cost Entry table, and the Cost Register table to make it possible to trace the connections between cost entries and general ledger entries.

- For each cost entry, Business Central saves the entry number of the corresponding general ledger entry in the G/L Entry No. field in the Cost Entry table.

- For combined cost entries, Business Central saves the entry number of the last general ledger entry, which is the entry with the highest entry number.

- The G/L Accountfield in the Cost Entry table contains the number of the general ledger account that the cost entry came from.

- In the Cost Register table, Business Central creates an entry with the source transfer from general ledger. The entry records the first and last entry numbers of the general ledger entries that are transferred, in addition to the first and last entry numbers of the cost entries that are created.