Author: Morgan Bazin

Solution Architect, Dynamics 365 Data & Dynamics

Long View

The 2023 release wave 1 for Dynamics 365 brings new innovations that provide you with significant capabilities to transform your business. CFOs are embracing digital transformation journeys across their entire organizations, with their systems and people. Their core financial systems require the ability to react to changes in economic conditions and country-specific regulations, provide deep financial insights, and financial automation. Having a system that provides the flexibility to handle complex scenarios, react quickly, and allow people to focus on value-added activities versus manual tasks is critical for business success.

In Part 1, let's examine the new developments in Core Financials:

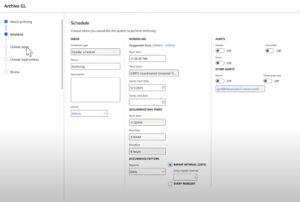

New Feature: Archive and Purge Data

- This feature allows organizations to archive data from Dynamics 365 Finance to Microsoft Dataverse in a secure, consistent, and automatic way.

- Archived historical information can be reported on using tools like Power BI.

- This feature is particularly useful for organizations with large amounts of data who want to reduce operational costs.

- Archiving data will also improve the performance of the application by reducing storage space requirements.

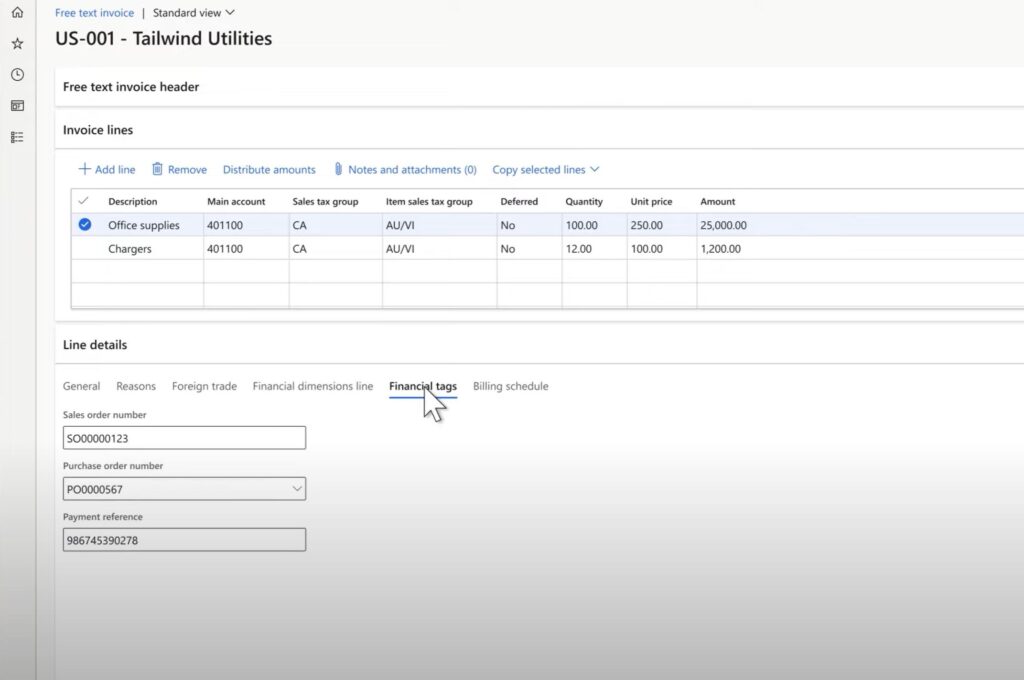

New Feature: Define Financial Tags to Support Analytical Reporting and Business Rule Automation

- Financial tags are a new feature coming to Dynamics 365 Finance.

- These tags can be used to track additional relevant information against a transaction, without the need to create a new financial dimension. This simplifies the chart of accounts.

- Organizations will be able to define up to 15 financial tags that can be entered against accounting entries that will be posted to the general ledger.

- Currently, values of financial tags are not validated or automatically populated. However, financial tags can be imported along with the rest of the transaction detail using transactional data entities.

New Feature: Add Additional Areas for Financial Tags Usage

- Building on the financial tags concept, this feature will begin to roll out financial tags to be used in transactions outside of the general ledger.

- By adding financial tags to other areas of the system, organizations will be able to leverage business rule automation and analytics in a wider view.

New Feature: Ensure Consistency, Reduce Errors with Default Financial Tags

- This feature will be the first iteration of a defaulting service for financial tags.

- Organizations will be able to define rules for the defaulting of transaction attributes such as financial tags.

- In this release, financial tags are being focused on. However, other attributes such as financial dimensions and transaction descriptions are expected in future iterations.

- This feature will assist organizations in maintaining consistent financial tag values, reducing manual entry time, and reducing errors.

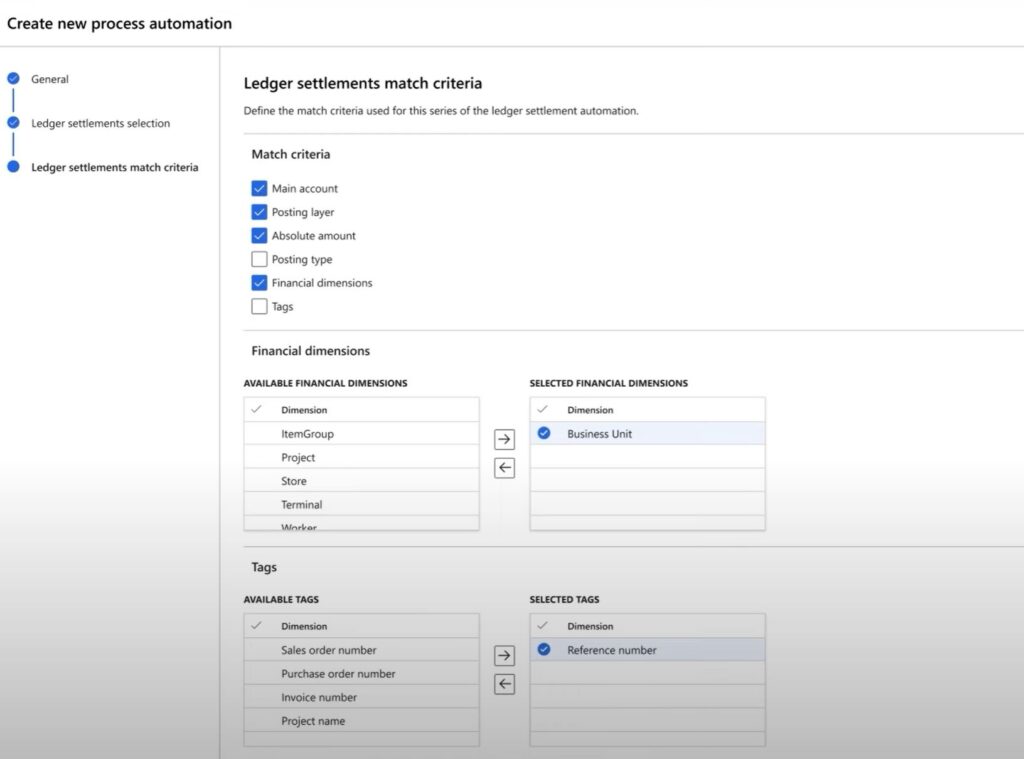

New Feature: Further Automate Ledger Settlements with Financial Tags

- As part of the 2022 release wave 2, automation to the ledger settlement functionality was introduced.

- With the addition of financial tags, this feature will enable the creation of matching rules that include financial tag values.

- This will further automate manual matching processes and reduce manual workload.

New Feature: Define Foreign Currency Posting Profile

- Organizations that operate in multiple countries often transact in multiple currencies.

- This feature improves visibility into and organizations' management of foreign exchange risk by allowing a greater granularity in reporting and posting of currency revaluation adjustments.

- Organizations will be able to define accounts against specific groups such as vendor or customer group, or against specific accounts such as an individual bank account or ledger account.

- This will help organizations better understand and manage foreign currency.

Subscribe to our newsletter for the latest updates.